Was your bankruptcy discharged/dismissed?

Your credit report may still be reporting inaccurately. We help consumers fix inaccurate post-bankruptcy credit reporting – and hold credit bureaus legally accountable at no cost to you.

Free Credit Report Review

Upload your Experian, Equifax, and TransUnion credit reports. We will review them for FREE to see if your Fair Credit Reporting Act rights are being violated

Why Choose Us?

With years of experience in consumer protection law, we specialize in helping people like you fix credit report errors after bankruptcy. Our legal team holds credit bureaus accountable under the Fair Credit Reporting Act (FCRA) — at no cost to you unless we win.

Fair Credit Reporting Act (FCRA) Lawyers

You have a right to accurate credit reporting after a bankruptcy discharge or dismissal. If the credit bureaus are still showing old, incorrect, or duplicate debts, you may be eligible for:

- Free correction of inaccurate post-bankruptcy credit reporting

- Compensation under the FCRA — including actual and statutory damages

- Increased chances of credit approval, loan access, and better housing

- Peace of mind knowing your credit report reflects your true financial status

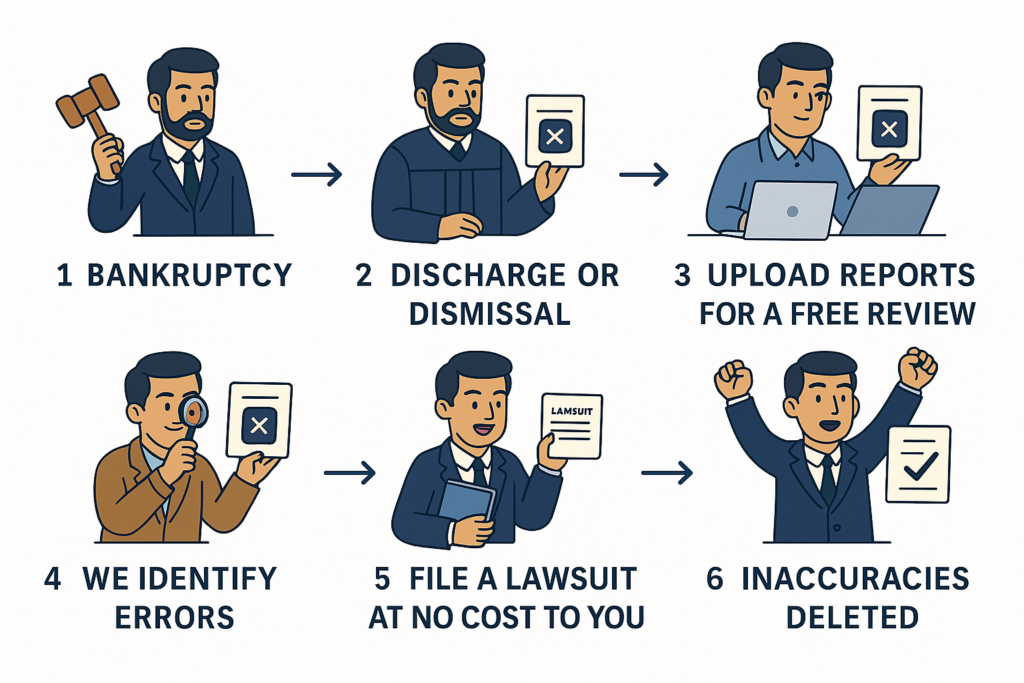

Our Process

What Inaccuracies Do We Look For?

After bankruptcy, your credit report is supposed to reflect the discharge or dismissal of your debts. Unfortunately, credit bureaus and creditors often get it wrong.

Balances That Should Be Zero

Debt that was wiped out in bankruptcy still shows a balance due, affecting your credit score and credibility.

No “Included in Bankruptcy” Notation

Accounts don’t show they were included in your bankruptcy, making it look like you simply didn’t pay them.

Inaccurate Bankruptcy Status

Your report lists the wrong bankruptcy type (Chapter 13 instead of Chapter 7) or incorrect filing/discharge dates or has continued to report the bankruptcy as open.

Duplicate Tradelines

The same account is reported multiple times — sometimes under different account numbers or lenders.

Lates Reporting After Bankruptcy

By law, creditors must stop reporting new delinquencies after your bankruptcy filing date.

Incorrect Payment Status

Accounts are shown as “120+ days late” or “charged off” after the bankruptcy was filed or discharged.

How It Works

Step 1: Get Your Free Credit Report Review

Upload your Experian, Equifax, and TransUnion reports for a free legal review. We’ll guide you through how to pull them online for free.

Step 2: We File A Lawsuit

If we find violations, we take legal action against the credit bureaus or creditors — at no cost to you. Our fees are paid by the defendants if we win.

Step 3: Errors Removed & Records Corrected

If successful, the reporting agencies are required to correct your reports — and you may be entitled to statutory or actual damages under the FCRA.

Free Legal Credit Report Review

Upload your reports for a free legal review. We will look for FCRA violations.

What our clients say

Testimonials are based on past individual experiences and do not guarantee results. Every case is different.

Caroline R.

He was very quick and effective in what needed to get done. Advocates for you and makes you feel like he's definitely got your back. Can't recommend him enough.

Gregory S.

Absolutely Amazing He Found An Inaccuracy On My Credit Report. He Filed A Lawsuit On My Behalf. Didn’t Cost Me Anything Credit Bureau Paid All His Fees. I Would Recommend Anyone Having Credit Issues Let Him Have A Look.

Tiffany G.

Grashan W.

David R.

I would recommend Haseeb legal LLC to anyone in need of a smart and diligent lawyer for legal action against inaccurate and adverse credit reporting agencies.

Danny J.

My first literal thoughts were, "What's the catch?" LOL. I am happy to say there was no catch, the creditors stopped calling, were REMOVED from my credit report.

Have questions? Start here

Visit AnnualCreditReport.com to download your Experian, Equifax, and TransUnion reports for free. Be sure to save them as PDFs and upload them here.

Not always. In many cases, we can advise you whether a prior dispute is needed. Every case is different, and we’ll guide you through what’s legally required.

Nothing. We offer a free legal review of your Experian, Equifax, and TransUnion credit reports. If we take your case, there’s no cost to you unless we win.

We can’t promise outcomes, but successful cases often result in corrected credit reports, financial compensation, and peace of mind knowing your bankruptcy is being reported accurately.

No. We’re a consumer protection law firm. We don’t offer “credit repair” — we take legal action when your rights under the FCRA are violated.

Yes. Even with a dismissed bankruptcy, your credit report must still reflect it accurately. If the reporting is misleading or incorrect, it may still violate your rights.

No — if the bankruptcy is legitimate and reported correctly, it must remain for 7–10 years. But we can help if creditors or bureaus are reporting incorrect information about your accounts after the bankruptcy.